The semigration trend towards Cape Town appears to be losing momentum as rising costs, congestion, and other challenges drive homebuyers to look elsewhere. Property data reveals a shift toward smaller coastal towns and a resurgence in demand within Gauteng, South Africa’s economic hub.

Smaller Coastal Towns Gain Appeal

According to Rhys Dyer, CEO of the ooba Group, the residential property market began a notable turnaround in late 2024. Following an interest rate cut in October, ooba Home Loans reported a year-on-year increase of 16% in application volumes, signalling renewed buyer confidence. Gauteng, particularly cities like Johannesburg and Tshwane, saw a rebound in house prices starting in April 2024, pointing to a resurgence in homeownership demand.

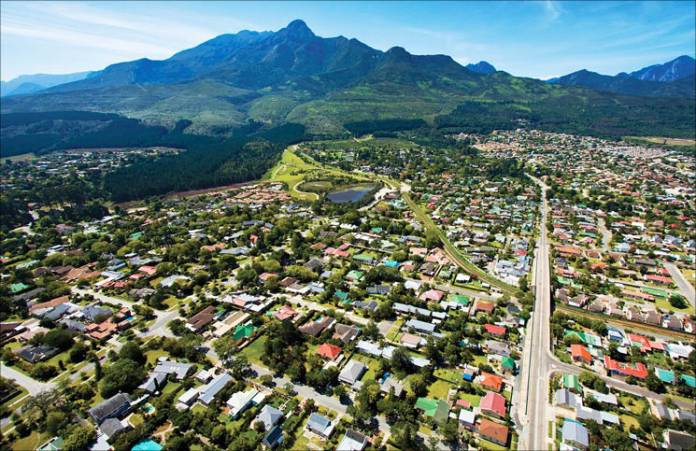

Meanwhile, smaller, more affordable coastal towns such as Knysna and George are gaining popularity. Dyer notes a sharp upward trajectory in these areas, reflecting a shift away from Cape Town due to rising costs, congestion, and challenges like long school waiting lists. Stats SA data shows a decline in approved building plans in Cape Town, further highlighting the slowdown in semigration to the Western Cape.

First-Time Buyers and Self-Employed Driving Growth

Despite these changes, the national property market remains resilient. First-time homebuyer activity rose, with applications increasing to 46.9% by December 2024, spurred by lower interest rates and consumer-friendly lending conditions.

As interest rate cuts and improved affordability continue into 2025, the semigration trend is expected to diversify further, favouring regions offering a balance of affordability and opportunity over the high costs of Cape Town. This marks a dynamic shift in South Africa’s property market as buyers explore new horizons.